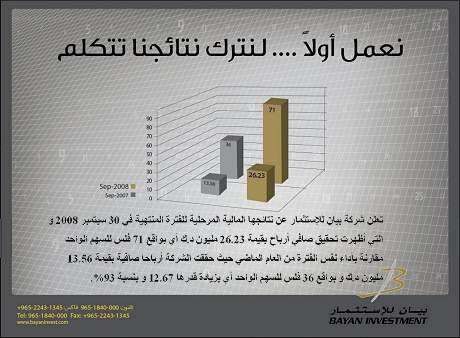

Bayan Investment announced its interim financial results for the period ended September 30, 2008, which showed net profits of KD26.23 Million and earning per share valued at 71 Fils, compared to the performance of the same period of last year as the company posted a net profit of KD13.56 million with 36 Fils earning per share, realizing an increase of KD12.67 Million with a rate of 93%.

Mr. Faisal Al Mutawa – Chairman and Managing Director of the company – referred these results to the firm steps the company has gone through the past months to protect its investments and maintain its performance and take caution and care in managing its local and international portfolios, in addition to the precise follow-up to the market activity taking into consideration the on going fall-off witnessed in the region starting from the beginning of the second half of 2008 and ending with the current global financial crisis. At the local level, distribution and diversification of the local investments, which includes several companies of good operational performance and strong financial position and been acquired long ago, led to reduce the impact of the decline of Kuwait Stock Exchange on the company’s financial position. Whereas on the international level, Mr. Al Mutawa stressed that the size of the company’s foreign investments is very limited in terms of the company’s total assets, and therefore its impact is marginal on the its financial results, which in turn minimized the risk and protected the assets prices of the company, thereby reducing vulnerability to the current financial crisis and strengthening the company’s financial position in general.

Mr. Al Mutawa expressed his pride for achieving such results in a difficult and unprecedented, in size and effects, economic circumstances that the entire world is going through, which is considered a strong evidence on the company’s ability to utilize opportunities and to maintain its leadership and clients confidence, and its ability to resist the effects of international markets fluctuations, or any other unfavorable situations.