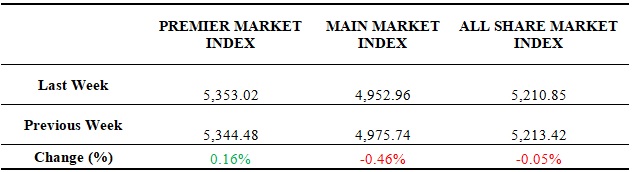

Boursa Kuwait ended last week with mixed performance. The Premier Market Index closed at 5,353.02 points, up by 0.16%, the Main Market Index decreased by 0.46% after closing at 4,952.96 points, and the All-Share Index closed at 5,210.85 points down by 0.05%. Furthermore, last week’s average daily turnover decreased by 19.23%, compared to the preceding week, reaching around K.D 28.94 million, whereas trading volume average was about 125.66 million shares, recording a decrease of 34.23%.

Boursa Kuwait was subject to profit collection operations during the last week which caused it to lose some of its profits realized in the previous weeks, and pushed its three indices to end the week with mixed closings, in a general quiet performance and relatively slow activity in preparation to establish new stock positions, especially after the listing of Integrated Holding Company’s stocks within the Premier Market Index early last week, which is considered the first listing since the new market segmentation, and the disclosure of one local bank that expressed its interest to merge with one of the GCC banks to form a large banking entity, which gave the traders an optimism dose and assisted the Premier Market Index to limit its profit collection operations, in addition to the quick speculations executed on some small-cap stocks that had a noticeable role in fluctuating the Main Market Index, which was reflected on the market indices’ performance and pushed it to end the week’s with fluctuation. The Premier Market Index’s gains reached by the end of the week around 0.16%, while the weekly loss of the Main Market Index and All-Share Index was 0.46% and 0.05% respectively.

By the end of last week, the number of the companies that disclosed its financial results for the first half of year 2018 reached 20 company, including the companies with different year end, realizing net profit of K.D. 186.68 million for the second quarter of year 2018, up by 18.42% compared to the same companies results for the same period of 2017. The Banks Sector acquired the lion portion of the same period’s profits, whereas 4 banks out of 12 listed banks in the Boursa disclosed its results of K.D. 151.54 for the second quarter of 2018 and up by 21.22% compared to its results for the same period of last year, which was around K.D. 125.01 million.

Moreover, Boursa Kuwait recorded weekly gains of around K.D. 11.4 million, as its market cap reached by the end of last week to about K.D. 28.71 billion, up by 0.04% compared to its level in the week before which was K.D. 28.7 billion approximately. Boursa Kuwait market cap gains since the application of the new market segmentation reached around K.D. 853.9 million, up by 3.07%. (Note: The market cap of the listed companies in the market is calculated based on the weighted average number of outstanding shares as per the latest available official financial statements).

Last week witnessed trading over 149 stock out of 175 listed stock in the Market, where prices of 57 stock increased against prices of 78 stock decreased, and prices of 40 stock remained at no change.

Sectors’ Indices

Seven of Boursa Kuwait’s sectors ended last week in the red zone, four recorded increases, while the Technology sector’s index closed with no change from the week before. Last week’s highest loser was the Consumer Services sector, as its index declined by 1.76% to end the week’s activity at 1,075.16 points, The Industrial sector was second on the losers’ list, which index declined by 1.16%, closing at 998.76 points, followed by the Basic Materials sector, which index declined by 1.09%, closing at 1,085.46 points.

On the other hand, Last week’s highest gainer was the Consumer Goods sector, achieving 1.28% growth rate as its index closed at 936.57 points. The Banks sector came in the second place, as its index closed at 1,088.96 points recording 0.38% increase. followed by Health Care sector, achieving 0.22% growth rate as its index closed at 995.60 points

Sectors’ Activity

The Banks sector dominated a total trade volume of around 255.07 million shares changing hands during last week, representing 40.60% of the total market trading volume. The Financial Services sector was second in terms of trading volume as the sector’s traded shares were 24.39% of last week’s total trading volume, with a total of around 153.26 million shares.

On the other hand, the Banks sector’s stocks were the highest traded in terms of value; with a turnover of around K.D 81.01 million or 55.99% of last week’s total market trading value. The Industrial sector took the second place as the sector’s last week turnover was approx. K.D 37.70 million representing 26.05% of the total market trading value.